Log Market - October 2024

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

The domestic demand for sawn timber in New Zealand remains well below production capacity. Mills have reduced orders for logs, so forest owners have to export a higher percentage of their production. Fortunately, At Wharf Gate (AWG) prices for export logs increased by an average of 9 NZD in October. The CFR log prices in China have risen steadily over the last couple of months. A strengthening USD against the NZD along with a relatively stable market in China means these AWG price increases should be consolidated in November. However, this pricing is still fragile, especially if there is significant increased log supply through New Zealand’s summer months.

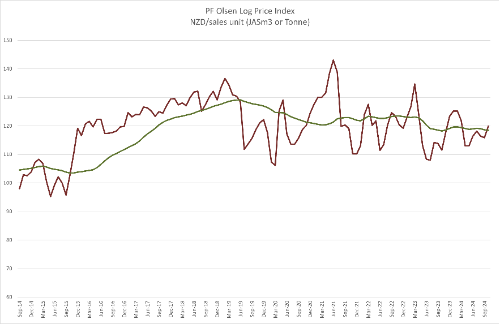

The PF Olsen Log Price Index increased $4 in October to $120. The Index is now $1 above the two-year average, and level with the five-year average.

Domestic Log Market

Sawmill managers report that sawn timber sales are still very slow with high inventory levels of sawn timber in the supply chain. It is estimated there is over 40% of sawmilling capacity not being used in New Zealand as mills slow down production. Spring has arrived in New Zealand and there has been little increase in demand for timber from DIY projects. This is the time of year when these projects begin, but it seems many households are controlling their spend and in the current economic slowdown. These sales are usually the higher margin sales as well.

Many mills continue to reduce orders of logs. With some harvest jobs starting as the weather improves in New Zealand there is more supply than local mills can handle.

Export Log Markets

China

China softwood log inventory is about 2.7m m3 and the inventory levels fluctuated along with supply levels, as log demand has remained steady at 60k m3 per day. The CFR price range for A grade is currently 124-128 USD per JASm3 for A grade. This has increased steadily over the month and now appears to be stable. However, wholesale log prices have recently dropped slightly (10-20 RMD per m3), as sawmill inventory levels have increased. The furniture and MDF markets are faring better than the construction market. Therefore, the higher-grade logs such as pruned and A grade, are easier to sell than the lower-grade logs. The smaller KIS grade logs are easier to sell than the larger KI grade logs as KIS (along with K grade) is used by MDF manufacturers.

The China Caixin Manufacturing PMI slipped in September to 49.3 from 50.4 in August. (Any number above 50 signals manufacturing growth). This is the lowest level since July 2023. In general, supply edged up while demand dropped. The log market was a contrast to this though as log supply dropped over this period.

Prices for new homes in China decreased 5.7% in September compared to the previous year. This is the 15th consecutive month of declining house prices. Despite the prolonged and well-documented troubles in the construction industry, there are some green shoots of recovery. In August the inventory of unfinished homes decreased by 12.7% from the previous year and sales of new homes were higher than new construction starts.

Repeated Government efforts to stimulate the construction industry have underwhelmed the market and had minimal impact. One concrete outcome is the Government will renovate 1 million homes in the older rundown dwellings in larger cities.

India

Approximately ten to twelve vessels are forecast to arrive in Kandla Port in November. These vessels are from Uruguay, New Zealand and Australia. Some logs have arrived unsold at Kandla Port and are now sitting in bonded storage yards for sale. Domestic logs are also available in Gandhidham at significantly lower prices. The A grade (before usance financing costs) sale price range around 140 USD is under pressure.

The sale price of green-sawn timber in Gandhidham has fallen by 50 INR per CFT. The price range is now 491-501 INR per CFT. Buyers anticipate further drops in sale prices. Production and demand should increase after the Diwali festival.

Tuticorin log demand has weakened as well with the onset of the Northeast monsoon rains. Most log supply in Tuticorin is coming from South Africa with high container costs affecting shipments from elsewhere. Demand may increase again in mid-January 2025 with the Indian winter harvest season.

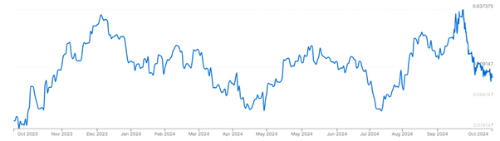

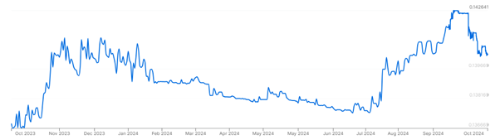

Exchange rates

The USD has strengthened against all currencies through October. This will have a positive impact on AWG calculations in November when log sales in USD are converted to NZD.

Source: TradingEconomics.com

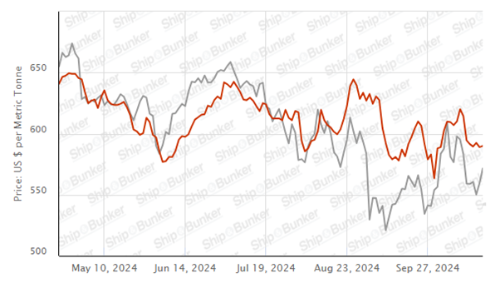

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - October 2024

The PF Olsen Log Price Index increased $4 in October to $120. The Index is now $1 above the two-year average, and level with the five-year average.

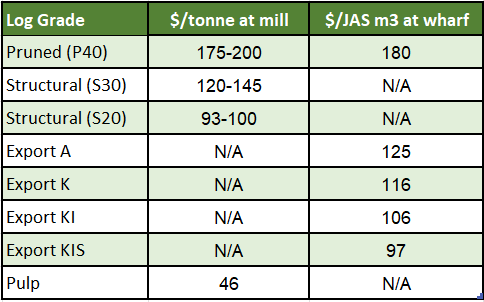

Indicative Current Log Prices – October 2024

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs. Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.