Log Market - November 2024

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

November AWG prices for export sawlogs were an average $3 higher per JASm3 than October pricing. Market prices had stabilized in China, so the AWG increases were due to the NZD weakening against the USD. AWG prices for pruned logs increased $10 per JASm3, as demand remains high for pruned logs. Prices for sawlogs have dropped 3 USD in the last week of November though.

Domestic log prices are flat as the pricing is set for Quarter 4. Sawmills in New Zealand are often having to compete in price wars to sell sawn timber, as demand continues to drop in the construction market.

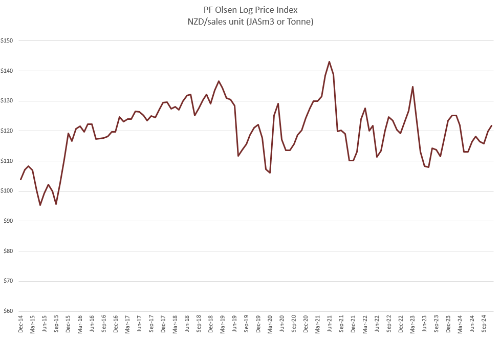

The PF Olsen Log Price Index increased $2 in November to $122. The Index is now $3 above the two-year average, and $1 above the five-year average.

Domestic Log Market

Some mills in New Zealand are taking a longer than usual production break over the Christmas/New Year period. This means if forest owners don’t time their log production to stop at the same time, then these logs will end up in the export market.

Many sawmill managers comment this is the worst they have seen the sawmilling industry in their career. Forest owners have been dealt another blow with a major buyer of pulp logs in the central North Island announcing its proposal to shut down its paper line. Oji Fibre Solutions is consulting on a plan to permanently shut its Kinleith Mill paper machine and focus on manufacturing pulp.

I have frequently commented about the drop in demand for structural sawn timber. Demand is now also down for pallets, so the lower grade products that would be used to manufacture pallets, are now being exported, generally to Asia.

Export Log Markets

China

China softwood log inventory dropped slightly to 2.4m m3 due to lower supply as log demand has remained steady at 55-60k m3 per day. The CFR price range for A grade is currently 125 USD per JASm3 for A grade.

After talking to some Chinese sawmill owners, I estimate about half of China’s mills will take a longer than usual break over the Chinese New Year Holiday period that starts 28th January 2025. This is due to a lack of demand for their product, and they don’t want to be left holding high inventory levels. If New Zealand forest owners take a longer break from harvest production over our Christmas/New Year period, then this drop in supply will match the drop in demand. If New Zealand forest owners overproduce logs at the start of the year, then this will most likely lead to significant increases in inventory levels in China during February.

The China Caixin Manufacturing PMI increased in October to 52.0 from 50.3 in September. (Any number above 50 signals manufacturing growth). This surpassed all market expectations. There was a solid rise in export orders and an increase in new business for the first time in four months. Market sentiment has been buoyed by the Government’s latest stimulation package, although previous stimulus packages have not created any real lift in log demand.

Many cranes sit idle at construction sites throughout China despite government attempts to generate activity.

Chinese log futures and log options can now be traded on the Dalian Commodity Exchange (DCE). Trade started November 13th for log futures and November 19th for log options. The DCE announced this market was created to address price volatility, enhance transparency in log pricing and offer effective tools for risk management. This is for softwood logs. On the first trading day 99,000 lots were traded with a turnover of 6.84b RMB (1.6b NZD). The benchmark price was officially set at 810 RMB per m3. This equates to 111.7 USD, which is well below the current price of 125 USD for A 3.9m. The first future supply contract commitment is July 2025. This future was trading at 770 RMB on 27th November. There are mixed opinions on how much influence this will have on the log market price setting.

India

Logs remain unsold at Kandla Port sitting in bonded storage yards for sale. Log supply is expected to slow down in December with about five vessels predicted to arrive. Kandla port is experiencing congestion due to the bunching of both break bulk and container vessels. A labour shortage at Gandhidham is also causing bottlenecks, as many workers did not return after visiting their villages for Diwali. The sale price of green-sawn timber in Gandhidham is in the price range of 511-521 INR per CFT.

Tuticorin log demand remains weak as they are now well into the Northeast monsoon rains. Logs are arriving in containers from South Africa and the USA. Currently container freight rates to India from New Zealand and Australia are about 13 times that of the cost to China. The price for sawn timber in Tuticorin is around 601-621 INR per CFT.

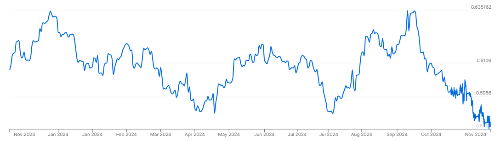

Exchange rates

The strengthening USD had a positive effect on AWG sale prices in New Zealand in November. The NZD is slightly down against the USD from when November AWG prices were set at the end of October, so any FX effect on December AWG pricing will be minimal.

NZD:USD

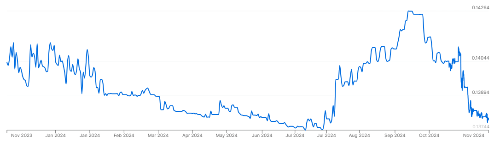

CNY:USD

Ocean Freight

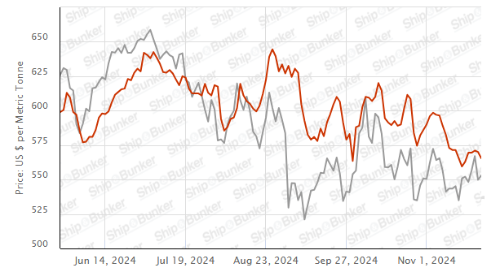

Shipping costs have stabilized.

The Baltic Dry Index (BDI) below is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI. The BDI index is now at its lowest point since February this year. This decline is shown across all vessel segments.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - November 2024

The PF Olsen Log Price Index increased $2 in November to $122. The Index is now $3 above the two-year average, and $1 above the five-year average.

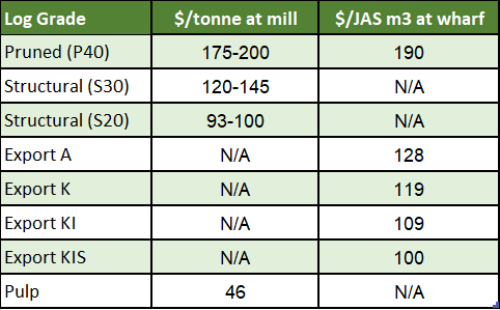

Indicative Current Log Prices – November 2024

These prices should be used as a guide only and specific advice sought for individual forests.