Log Market - August 2025

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

The domestic demand for logs and sawn timber remains very subdued, especially for structural grade. In the domestic market, New Zealand sawmills continue to face pressure from rising operational costs. Carter Holt Harvey (CHH) has announced its intention to close its Nelson operation to consolidate production in the North Island.

At Wharf Gate (AWG) prices for export logs had an un-forecasted 8 NZD per JASm3 increase. This increase was more due to exchange rate and ocean freight cost fluctuations than any market improvement in China.

Log demand in China has increased to around 55,000 m³ per day, with stable softwood log inventories showing a modest month-on-month decrease of approximately 4%. Demand from India remains soft as the country looks forward to increasing economic activity after Diwali. There is also a lot of uncertainty with the US tariffs. Fortunately, log volumes from New Zealand remains below normal levels, helping to balance log supply and demand.

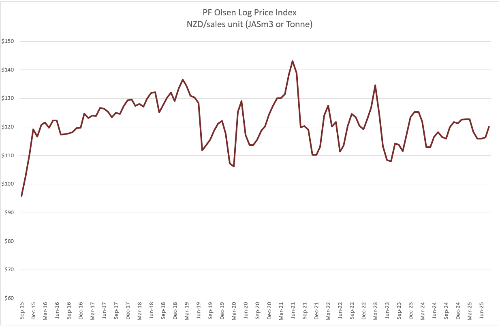

The PF Olsen Log Price Index increased to $120. This is $1 above the two-year average and $1 below the five-year average.

Domestic Log Market

The move is symptomatic of a broader malaise in the domestic forestry sector: residential building remains subdued, with dwelling consents slipping and the 12-month housing pipeline well below its 2022 peak. This has dampened demand for framing and appearance-grade timber. Processors also face elevated operating costs and global uncertainties—including currency volatility, shipping disruptions, and shifting trade dynamics, that are squeezing margins.

Export Log Markets

China

CFR prices for A-grade logs remain in the range of USD 113–117 per JASm³ for August vessel arrivals. Log demand in China has increased slightly over the last month to around 55,000 m³ per day. Log demand is expected to increase as economic activity increases as temperatures drop when China heads into Autumn. Log supply from New Zealand remains below normal levels so softwood log inventories have decreased slightly and now sit at approximately 2.6 million m³.

The Caixin China General Manufacturing PMI slipped into contraction in July, falling to 49.5, down from 50.4 in June—a surprise reversal that dashed hopes of sustained momentum. Output shrank for the second consecutive month, dragged down by weakening export orders amid enduring global trade uncertainty. Although purchasing activity rebounded slightly after two months of decline, and input costs edged upward for the first time in five months, selling prices continued to fall, reflecting intensified competition. Business sentiment improved modestly yet remained muted compared to its long-term average.

The CNY has strengthened about 1.15% against the USD which provides more buying power to Chinese log buyers

India

Log demand in India remains suppressed, with market expectations pointing to an uptick only after Diwali in October. Green sawn timber in Ghandidahm is INR 531-541 per cubic feet.

Most of New Zealand’s log exports to India are used for manufacturing timber pallets and packaging, primarily linked to India’s export-related logistics sector. However, recent U.S. trade policy developments complicate this picture. The U.S. has imposed steep tariffs—now reaching 50%—on a wide range of Indian exports, particularly hitting labour-intensive sectors such as textiles, gems, jewellery, leather, and seafood. These measures are anticipated to sharply curtail US bound shipments. In turn, Indian exporters are facing mounting pressure to seek urgent mitigation strategies, including shifting export destinations and ramping up government support.

This trade shock poses a potential two-fold challenge for New Zealand log exporters. First, slowed manufacturing activity in India—particularly in preparation and transport of goods bound for the U.S.—could further delay domestic demand for packaging timber in the short to medium term. Secondly, the tariff-induced market distortion may suppress growth beyond Diwali, as export firms may defer investments or cut back on packaging volumes amid declining competitiveness.

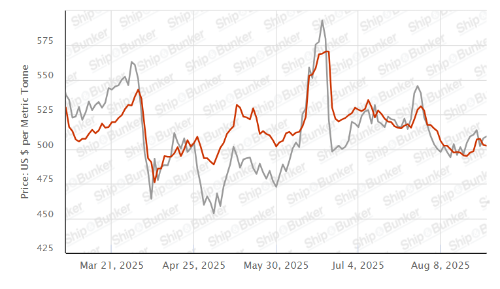

Shipping costs

Ocean freight rates for shipping New Zealand logs to China have remained stable this past month, holding steady at approximately USD 30 per JAS m³ for vessels loading at two North Island ports. The benchmark for dry bulk rates, the Baltic Dry Index (BDI) has remined stable since it dropped from its peak in July this year.

There are emerging upward pressures on Handymax vessels. Charter rates on key routes, such as Southeast Asia to China, are currently in the range of USD 13,500–17,500 per day, hinting at increased load activity and tighter tonnage in those lanes. Conversely, Panamax vessel demand remains weak, with freight costs continuing to trail Handymax and Ultramax peers amid an ample supply of available tonnage.

The BDI is a composite index derived from three sub-indices representing different vessel sizes: Capesize (40%), Panamax (30%), and Supramax (30%). It reflects the average daily USD hire rates across 20 major ocean freight routes. While most New Zealand log exports are transported via Handysize vessels (not directly included in the BDI), this segment remains closely influenced by broader trends in the index.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - August 2025

The PF Olsen Log Price Index increased to $120. This is $1 above the two-year average and $1 below the five-year average.

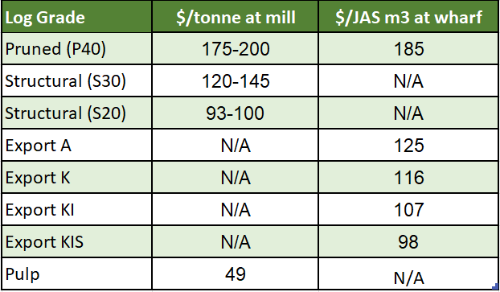

Indicative Current Log Prices – August 2025

These prices should be used as a guide only and specific advice sought for individual forests.