Log Market - August 2024

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

August At Wharf Gate (AWG) prices around New Zealand decreased by an average of 2 NZD from July prices. A strengthening NZD against the USD means September AWG log prices in NZ will be under further pressure.

There was further bad news for the New Zealand wood processing and fibre recycling industry with three facilities closing operations. Sawn timber demand remains very low.

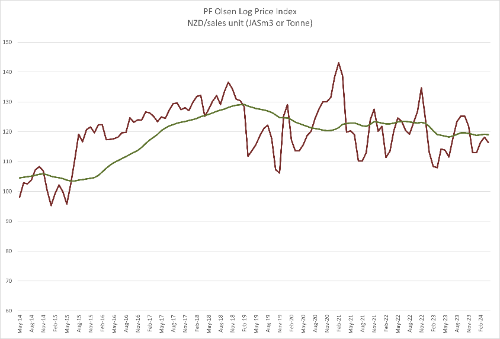

The August PF Olsen Log Price Index dropped back $2 to $116. This is $3 below the two-year average, and $4 below the five-year average.

Domestic Log Market

Many domestic mills have slowed down production as demand is still very weak. A higher proportion of their lower grade products are now having to be exported at lower returns than domestic sales. Sales in outdoor products such as fencing, retaining walls etc, is very low. Timber demand in an already subdued market is made even worse due to the recent wet weather in the North Island. Mills don’t expect a significant increase in demand come spring. Export sales of clear boards are okay but this supply line is also under pressure due to reducing demand in the US and Europe.

Mills in New Zealand are facing rising costs with electricity costs in particular increasing rapidly. Months of dry weather in the South Island has led to low hydro storage levels which along with falling gas reserves has meant rapidly escalating wholesale electricity prices.

Oji Fibre closed its Recycle Pulp Mill in Penrose and Winstone Pulp International (WPI) closed its Karioi Pulpmill and Tangiwai Sawmill. Both companies state soaring electricity costs were a significant factor in these decisions. This has flow-on effects to other mills as sawmills sell their sawdust to Karioi Pulp Mill. This volume will now have to be sold at alternative markets that will likely incur more transportation cost.

Export Log Markets

China

China radiata pine log inventory is about 2.85m m3 with total softwood about 3.5m m3. Log demand has been just over 50k per day but has increased in the last week to 60k m3 per day. The CFR price range for A grade is currently 115-120 USD per JASm3 for A grade. This is 3-4 USD below July pricing. The CNY has strengthened against the USD so log exporters to China expect this will help to maintain pricing levels.

The China Caixin Manufacturing PMI slipped in July to 49.8 from 51.8 in June. (Any number above 50 signals manufacturing growth). This was the first dop in factory activity since October last year. Output grew at the slowest pace in nine months due to a slow-down in export orders.

The China property market remains very subdued. The government’s various attempts to stabilise the property market have not worked as hoped. Indeed, in June the total 70-city average property price indicator declined 7.9% on a year-on year basis. This was the biggest annual drop on record.

The government tried to introduce price controls to avoid falling house prices, but a growing number of mortgage holders have failed to fulfill their mortgage obligations. Therefore, banks have been forced to auction these properties at basement prices. This has undermined the government price control. Ironically the banks are state owned.

Beijing’s latest attempts to stabilize the property market is allowing local governments to issue special bonds to purchase unsold properties (and often convert to affordable housing) as well as mandating the sale of completed homes rather than the longstanding practice of pre-selling unfinished homes. This will be welcomed by buyers but may place further cash flow strain on developers.

As mentioned in previous Wood Matters, the high level of public debt is constraining any further ability to balance the property market. According to the International Monetary Fund (IMF), China’s augmented public debt stock last year was 116% of GDP.

Some analysts suggest Beijing is also keen to reduce its reliance on the property market to free up capital and resources for other kinds of economic activity that is more strategically important. This is in the fields of semi-conductors and technology, AI, biopharma, green energy and agricultural efficiency. Diversification is a sound economic policy, but this may also be driven by Beijing wanting to cushion the shocks from any coordinated set of sanctions from the West in an increasingly divided world.

India

Supply from Uruguay has increased with four vessels to load from Uruguay and arrive in Kandla in September. When combined with supply from New Zealand and Australia this market may reach saturation. The Gandhidham market is experiencing poor lumber demand due to rains. This may continue until the end of October, when the Diwali festival will be celebrated.

At Gandhidham, green sawn timber is sold at 571 INR per CFT. Unlike previous times however, there is currently no premium for radiata pine sawn timber. Sawn timber prices may weaken in September and October, due to more log arrivals in bulk vessels and poor lumber demand.

Tuticorin is facing log shortages from Australia and New Zealand in containers, as liners have increased the freight rates. Prices for southern yellow pine (SYP) logs have increased about 15 USD per ton, due to freight increases. South Africa may resume loading pine logs to Tuticorin, as they have recouped Methyl Bromide supplies.

The price for sawn timber in Tuticorin is around 650 INR per CFT. Demand for pine logs in Tuticorin may increase, as local silver oak log supplies have been affected, due to shortages and local demand from plywood factories in India.

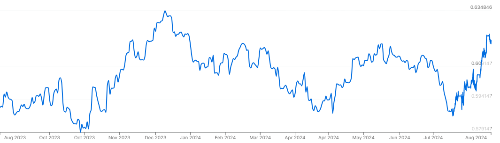

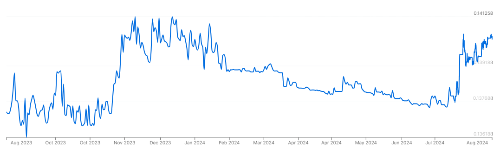

Exchange rates

The NZD strengthened against the USD in August, and this will negatively affect the AWG calculations of New Zealand log buyers by about 6-7 NZD per JASm3. The CNY has also strengthened against the USD, and this will increase the buying power of Chinese log buyers.

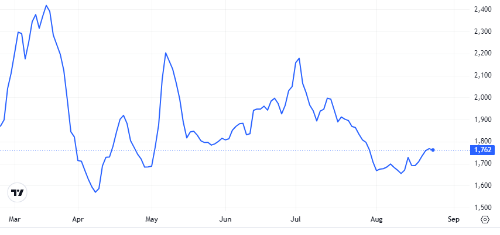

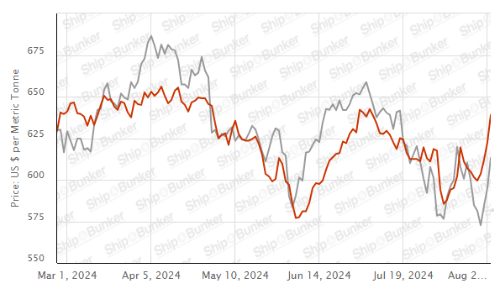

Ocean Freight

Ocean freight rates have stabilized with some small reductions. Shipping logs from the North Island of New Zealand to China is now in the mid 30's per JASm3.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - August 2024

The August PF Olsen Log Price Index dropped back $2 to $116. This is $3 below the two-year average, and $4 below the five-year average. When the two-year Index average is added to the graph, you can see the Index has been dropping since 2019.

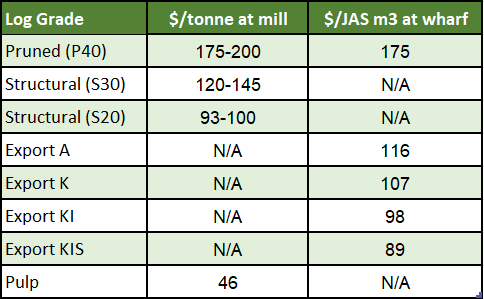

Indicative Current Log Prices – August 2024

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs. Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.