Log Market - April 2025

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

The New Zealand log market continues to face significant challenges as international market conditions weaken. In China, the A-grade CFR price has fallen sharply to 110 USD per JASm³, driven by increased log supply and cautious construction activity. India is also showing signs of softening, with uncertainty around global trade flows leading to weaker demand and lower timber prices.

Domestically, the construction sector remains subdued despite recent interest rate cuts, with residential building consents trending lower and government infrastructure spending reduced. Although lower interest rates may support a recovery later in the year, this has yet to materialise in increased log demand.

Compounding these pressures, the New Zealand dollar has strengthened against the US dollar, reducing the competitiveness of New Zealand logs in overseas markets. This currency shift is putting further downward pressure on At Wharf Gate (AWG) prices for forest owners.

AWG prices for export logs in New Zealand reduced by an average of 9 NZD per JASm3 and are expected to fall further in May as log prices continue to soften and the NZ dollar strengthens against the US dollar.

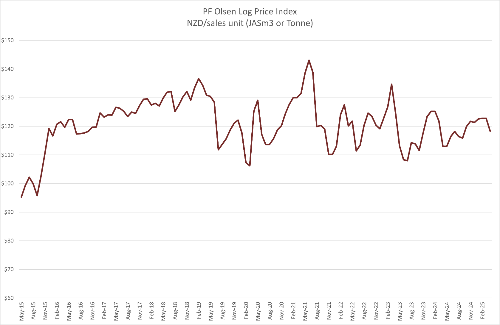

The PF Olsen Log Price Index has fallen to $118. The Index is now $1 above the two-year average, and $2 below the five-year average.

Domestic Log Market

The New Zealand domestic log market continues to face significant challenges, primarily due to a sustained downturn in construction activity. Recent data from Stats NZ indicates that in the year ended February 2025, there were 33,595 new dwellings consented, marking a 7.4 percent decrease compared to the previous year. This decline underscores the ongoing softness in the residential construction sector, which directly impacts demand for structural logs and timber products.

Sawmills are navigating a delicate balance. While there is a pressing need to adjust log prices to maintain operational viability, there's also a recognition that substantial price reductions could lead to decreased harvesting activities, further tightening supply chains. This precarious situation is compounded by broader economic factors, including reduced government spending on infrastructure projects and tighter credit conditions, both of which are dampening overall construction activity.

Although recent interest rate cuts offer a glimmer of hope for revitalizing the housing market, the anticipated uptick in construction activity has yet to materialize. As winter approaches, the domestic log market remains cautious, with stakeholders closely monitoring economic indicators and housing demand trends.

Export Log Markets

China US Tariffs

Currently sawn timber (lumber in American terms), wooden panels and other wood products are excluded by the US from reciprocal tariffs. This includes rough and surfaced lumber, plywood, MDF and other wood-based panels, blockboards, etc. However, these products are grouped together with automobiles, pharmaceutical, energy, and semi-conductors into strategic products which are included in a separate investigation and as stated on the executive order "may become subject to future Section 232 tariffs". Industry analysts understand lumber and wood products are viewed by the US administration as part of products groups which they wish to permanently bring back to the US, so are likely to be subject to special higher duties in the future. This adds to the uncertainty for manufacturers purchasing logs to make these products to export to the US.

China

China softwood log inventory has started to rise as the usual peak March harvest production in New Zealand starts to arrive in China, and daily port off-take of logs remains consistent at about 60-65k m3 per day. The CFR price for logs is dropping as the market is uncertain about the effects of the tariff war between China and the USA and how it will affect world trade. The CFR price for A grade logs is currently about 110 USD per JASm3, and exporters continue to face pricing pressure.

Log supply from New Zealand is expected to decline, initially due to the shortened April work calendar, with only 19 working days because of Easter and ANZAC holidays. Wet weather across much of the country is also likely to disrupt harvesting operations. Beyond these seasonal factors, harvesting activity is expected to slow further in response to lower AWG prices.

The Caixin China General Manufacturing PMI rose to 51.2 in March, from the previous 50.8 in February, again surpassing market expectations of 51.1. This is the highest reading since last November, with a sustained rise in new orders (foreign sales grew the most in 11 months). Business confidence, however, has weakened due to increased uncertainty about tariffs and trade barriers around the world.

India

Demand for sawn timber is decreasing in India as tariffs (and uncertainty around tariffs) to the USA are reducing exports. Indian goods to the US are subject to a 27% tariff. This is reducing demand for pallets used in exporting these goods. Prices for sawn timber in Gandhidham in April are the same as March, 491 INR per CFT for taeda pine green sawn timber and 521 INR per CFT for radiata pine green sawn timber.

New Zealand and Australian log exporters are selling A grade logs around 120 and 127 USD per JASm3 respectively. South American logs sell for below 110 USD per JASm3 for A grade. Approximately eleven shipments of logs will arrive in Kandla in May.

Tuticorin continues to receive logs in containers from South Africa, K grade at 105 USD per metric tonne CFR LC 180 days. Green sawn timber is sold at 601 INR levels.

Pallet manufacturers are importing kiln dried (KD) sawn timber from Europe, which is adversely affecting the sawmill industry in India. Many sawmills in India are therefore not running at full capacity. If container freight costs to India reduce, Canada - which now supplies lesser grade KD SPF sawn timber to China at 155 USD per m3- may also supply sawn timber to India.

Exchange rates

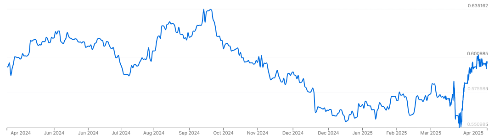

The New Zealand dollar has strengthened by just over 4.5% against the US dollar through March. This FX shift alone will negatively impact May AWG pries by about 5 NZD per JASm3.

The CNY has been more stable against the USD decreasing by 0.45% through March.

NZD:USD

Currency graphs source: XE

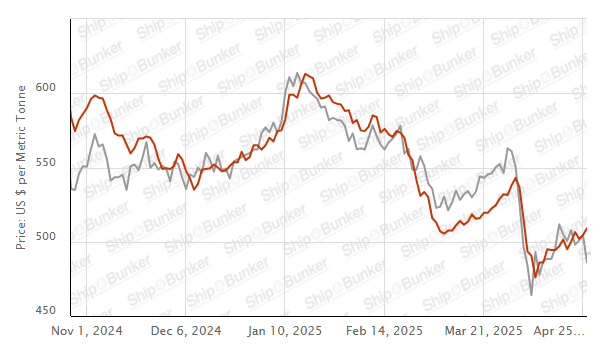

Shipping costs

The cost of shipping logs from New Zealand to China has been stable over the last month, but exporters anticipate shipping costs reducing from late May due to less global demand for shipping. Some exporters use a shipping combination of selling top deck cargo in Korea (which doesn’t require fumigation or debarking), then selling the underdeck cargo in China. The Korean market has also heavily reduced its log demand, so this option for log exporters is currently very limited.

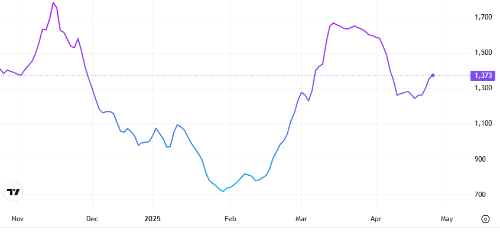

The Bulk Dry Index (BDI) shown below is a composite of three sub-indices, each covering a different carrier size; Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI. The BDI index is now at its lowest point since February this year. This decline is shown across all vessel segments.

Source: TradingEconomics.com

Source: Ship & Bunker

PF Olsen Log Price Index - April 2025

The PF Olsen Log Price Index has fallen to $118. The Index is now $1 above the two-year average, and $2 below the five-year average.

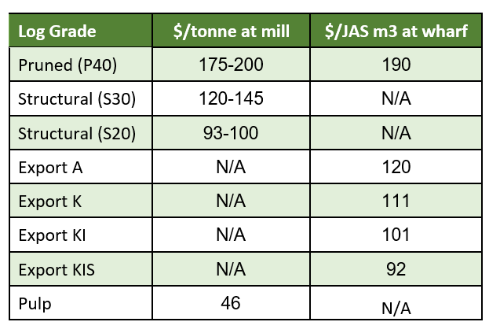

Indicative Current Log Prices – April 2025

Please note these are indicative AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs. Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation.

These prices should be used as a guide only and specific advice sought for individual forests.