Log Market – November 2022

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

At Wharf Gate (AWG) prices for export logs reduced an average of 6 NZD per JASm3 across ports in New Zealand in November. This was caused by a reduction in CFR log prices in China combined with the NZD strengthening against the USD. Log inventory in China remains stable. There is still a lot of uncertainty in China, especially with how the government will continue to manage Covid-19.

Domestic Log Market

Sawn timber exports remain difficult. China is relatively quiet and has price pressure. Their South East Asian customers struggle with the American buyers of their mainly furniture products demanding extended payment terms as well as coping with tariffs imposed by the US government. They expect better demand in Quarter 2 of next year.

Many sawmills are closing for year-end in mid-December. This is a bit earlier than in the last couple of years as mills struggled to keep up with demand.

Export Log Market

China

China softwood log inventory is stable at about 3.5m m3 and port off-take is stubbornly sitting at about 60k per day. Covid restrictions continue to significantly constrain economic activity in China.

The current sale prices for A grade logs range between 120-123 USD per JASm3. Expectations are relatively stable pricing through to the CNY then an increase in CFR prices as log buyers prepare for March and April, which are traditionally the busiest construction months in China.

The China stock market prices had increased through November when market sentiment improved after the Chinese government announced some minor changes to their Covid policy. While these changes were not significant the market read these as a signal for a potential easing of the strict Covid management regime over time. Meetings between leaders from China and the US also prompted hopes of a better economic relationship. However, stock market prices which had risen approximately 20% through November have dropped approximately 4% in the last week as Covid fears resurface.

Shares of Country Garden (China’s largest property developer by sales) more than doubled after the central bank and banking regulator announced measures that encouraged banks to assist the real estate industry. These measures are more about short term liquidity relief for developers than a fundamental improvement in the market.

The October Caixin China Manufacturing PMI increased to 49.2 from 48.1 in September. While there is still downward pressure on the China economy, sentiment has edged up from the 34-month low in September.

Log supply will remain low as Southern Yellow Pine (SYP) imports from the USA remain constrained by the pine nematode policies implemented by China earlier in the year. In Quarter 3 this year only two shipments from South America (one handy and one Capesize). Supply from New Zealand will reduce with less harvesting during December and January. Many sawmills in New Zealand are closing earlier for year-end holidays this year (after a hectic couple of years), so harvest operations will also finish relatively early in many locations.

India

Activity in Gandhidham is slow to recover after the Diwali holidays due to negative sentiment. Log importers and sawmills report fewer enquires from their customers for green sawn timber. The sale price for green sawn timber is now approximately 501-511 and 591-601 INR per CFT for timber from South America and Australian logs respectively.

Exports from India fell to 29.78 b USD in October 2022 from 35.45 b in the previous month, the lowest since February 2021. In October last year, exports were 17% higher at 35.73 b USD. This has negatively affected the demand for sawn timber to make export packing pallets. There is an expectation North Indian demand might increase by March 2023 when the summer harvest starts and Indian exports increase.

Log shipments from South America have reduced drastically, as unsold logs are still at bonded warehouses in Kandla and being sold at low prices.

The Tuticorin market is also weak at 650 INR per CFT for sawn timber. Green sawn timber from Gandhidham is being supplied to South Indian markets like Bengaluru, Hyderabad by coastal container service. This has put pressure on South Indian mills.

Indian buyers are waiting for NZ MPI to restart issuing Phytosanitary certificates for India bound shipments, from 1 January 2023. This is possible for underdeck, unfumigated logs, which needs to be fumigated on arrival in India, with Methyl Bromide.

Many Indian log buyers are nostalgic about the grading, quality, and measurement of New Zealand radiata pine logs, and hope the recommencement of shipments becomes a win-win proposition to sellers and buyers.

Exchange rates

Both the NZD and CNY have strengthened against the USD through November.

NZD:USD

CNY:USD

Ocean freight

Shipping costs have dropped by about 3 USD per JASm3 over the last month.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI. The BDI has risen slightly in September from a two year low.

Source: TradingEconomics.com

Source: Ship & Bunker

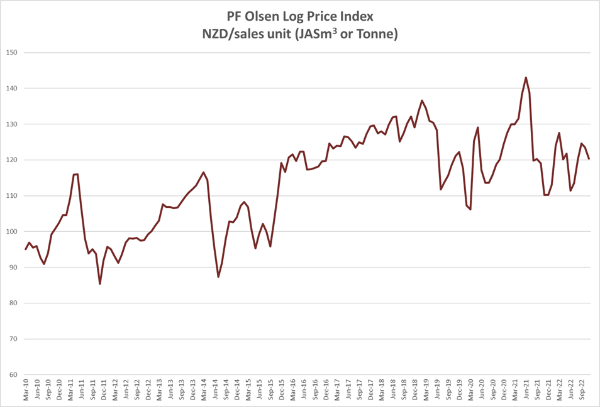

The PF Olsen Log Price Index decreased $3 in November to $120 which is $3 below the two-year and five-year averages.

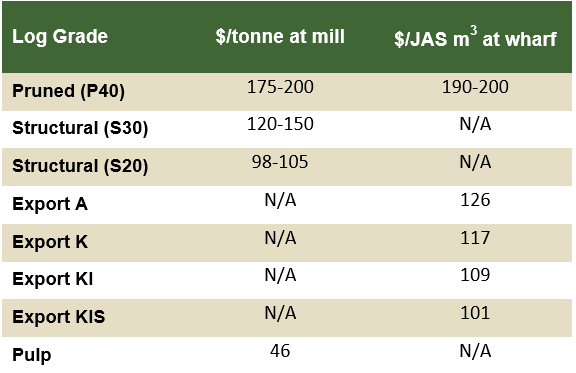

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices - October 2022

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs.

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.