Log Market – December 2022

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

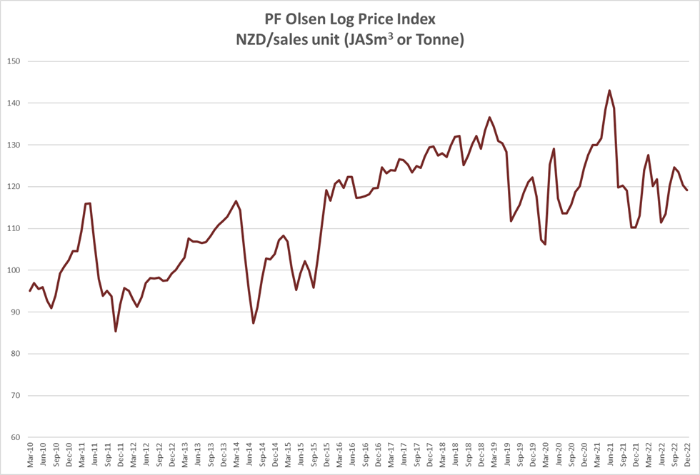

The PF Olsen Log Price Index decreased $1 in December to $119 which is $4 below the two-year and five-year averages.

Export Log Market

China

The Chinese government has announced a loosening of monetary policy and business friendly laws, (some of which are directly targeted at the real estate industry), as they look to revive the economy after the Covid induced economic downturn. The actual stimulus packages are likely to be less than 2022, so China is relying on creating the environment for business and increasing domestic demand.

India

The market still awaits confirmation from the Indian Plant Quarantine Authority on the treatment requirements and cost charges of unfumigated logs from New Zealand.

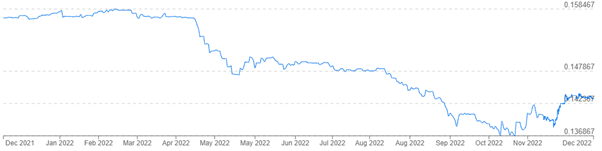

Exchange rates

The NZD strengthened considerably during November and this affected December AWG log prices in New Zealand. The NZD is still volatile against the USD, but the underlying upward trend has stopped in the last couple of weeks. The CNY has stabilised against the USD in the last couple of weeks.

NZD:USD

CNY:USD

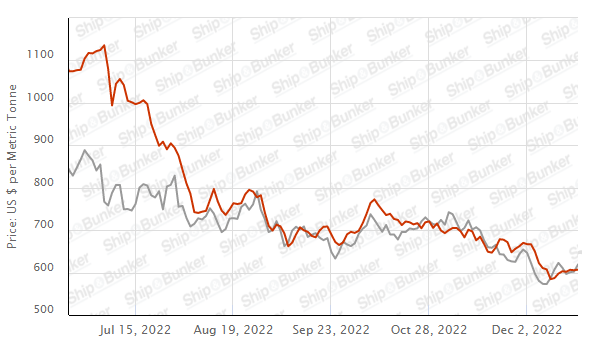

Ocean freight

Shipping costs have continued to drop and the average shipping rate from the North Island of New Zealand to China is now just over 30 USD.The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - December 2022

The PF Olsen Log Price Index decreased $1 in December to $119 which is $4 below the two-year and five-year averages.

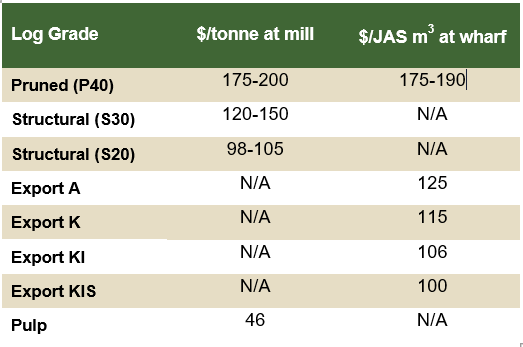

Indicative Average Current Log Prices - December 2022

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.