Log Market - November

Market Summary

The At Wharf Gate (AWG) prices for export logs dropped on average $18 per JASm3 in the higher quality grades and $23 per JASm3 in the lower quality grades. This was a combination of reduced CFR log prices in China and the NZD strengthening against the USD.

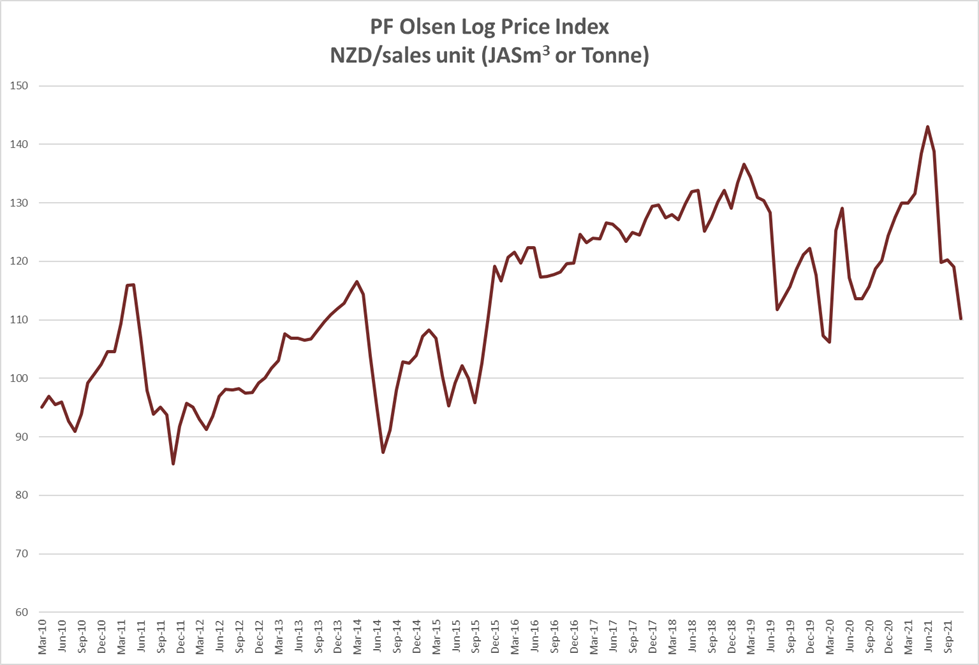

The PF Olsen Log Price Index dropped $9 in November to $110. The index is currently $12 below the two-year average, $13 below the three year-average and $15 below the five-year average.

Although the China log market remains subdued, AWG prices should increase in December due to ocean freight costs dropping 35% in the last month. Significantly reduced log supply from New Zealand should see CFR prices increase in China in January.

Domestic Log Market

Log Supply and Pricing

Log pricing has generally remained flat as pricing was set last month for Quarter 4. While many harvesting crews are taking a longer Christmas break than normal, virtually all mills report they have sufficient log supply over this period.

Sawn Timber Markets

Domestic demand for sawntimber remains strong across all grades but there is some concern about the viability of building companies and construction projects due to the escalating costs of building materials

Export Log Market

AWG Prices

The AWG price range between exporters and ports remains extremely varied. This is due to varied sales strategies in China and the timing of securing shipping. Some exporters factored in a bigger price drop last month so didn’t reduce prices as much this month, compared to other exporters who held prices higher last month but had a bigger reduction this month.

China

The price for logs in China has dropped about 30 USD per JASm3 (17%) in the last month. The price is still highly variable with some exporters achieving sales for A grade logs at 150 USD while others are 140 USD per JASm3. As mentioned in previous Wood Matters articles there is a structural shift in the Chinese economy with the government looking to slow the property market and reduce debt levels, but as is often the case the market has overcorrected.

Softwood inventory levels are flat at 4.8m m3 and daily offtake is steady at 75k per day. While this is the time of year we usually see daily offtake hit 100k per day, there will be over 2m m3 fewer logs supplied from New Zealand in November and December than usual. This is because many forest owners have slowed or suspended harvest operations, and most continuing harvest operations will be taking an extended Christmas break this year.

The Caixin China General Manufacturing PMI unexpectedly rose from 49.2 to 50.6 in October. This was on the back of a further recovery in domestic demand. Economists note the government needs to further address how to balance controlling Covid19 outbreaks with maintaining economic activity.

If low harvest levels continue in New Zealand, there is likely to be a significant reduction in China log stocks and a shortfall of logs by the Chinese New Year in February. Much will depend on how the China property development sector recovers from its current situation.

India

The port of Kandla that supplies the sawmilling town of Gandhidham is oversupplied. There are reports of over 400,000m3 of unsold South American logs sitting unsold at the port, bonded warehouses, and in inbound vessels. Estimates of nine log vessels arriving in December means oversupply will last into Quarter 1 2022.

Due to the anticipated oversupply situation in November and December, demand is weak and the price for Uruguay lumber has fallen from INR 581 to INR 521 per CFT in the last month. The price for Radiata lumber has fallen from INR 641 to INR 571 per CFT.

Exchange rates

The NZD has strengthened against the USD by three cents over October. This adversely affected the November AWG pricing by about 6 NZD per JASm3. The NZD has weakened by two cents in the first three weeks of November, and this will also help December AWG pricing. The CNY continues to strengthen against the USD.

NZD: USD

CNY: USD

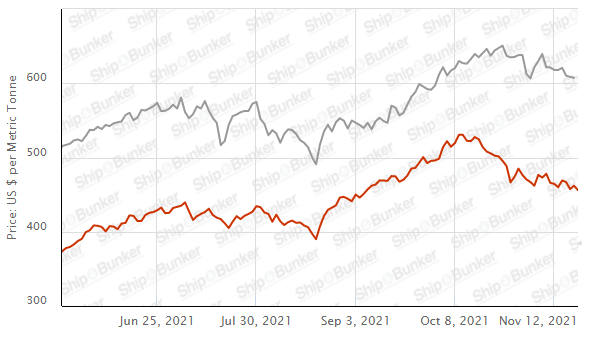

Ocean Freight

Shipping costs from New Zealand to China have dropped by 35-40% in the last month. Shipping costs from North Island ports are now in the low to mid 40’s USD per JASm3. The decline in the Baltic Dry Index is displayed in the graph below.

A softer dry bulk market is forecast for Quarter 1 2022. Iron ore prices have plummeted to below $100 USD per mt causing uncertain forecasts for shipping demand. Natural gas is the primary feedstock for most nitrogen fertilisers. The energy shortage makes natural gas more expensive which reduces fertiliser demand which reduces supramax and handysize voyages.

Source: TradingEconomics.com

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

The Singapore Bunker Price has dropped through November.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – November 2021

The index is currently $12 below the two-year average, $13 below the three year-average and $15 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

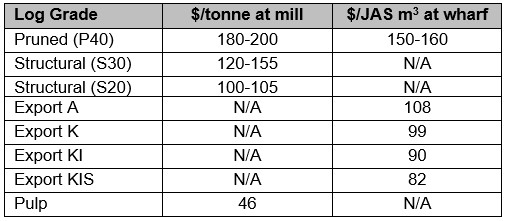

Indicative Average Current Log Prices – November 2021

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.