Log Market - April

Market Summary

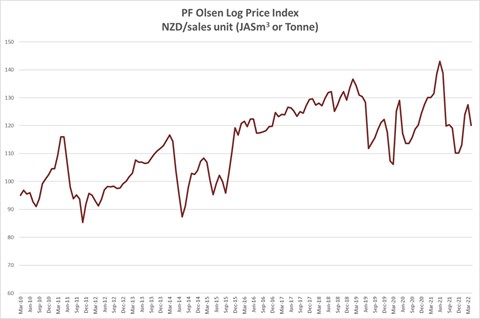

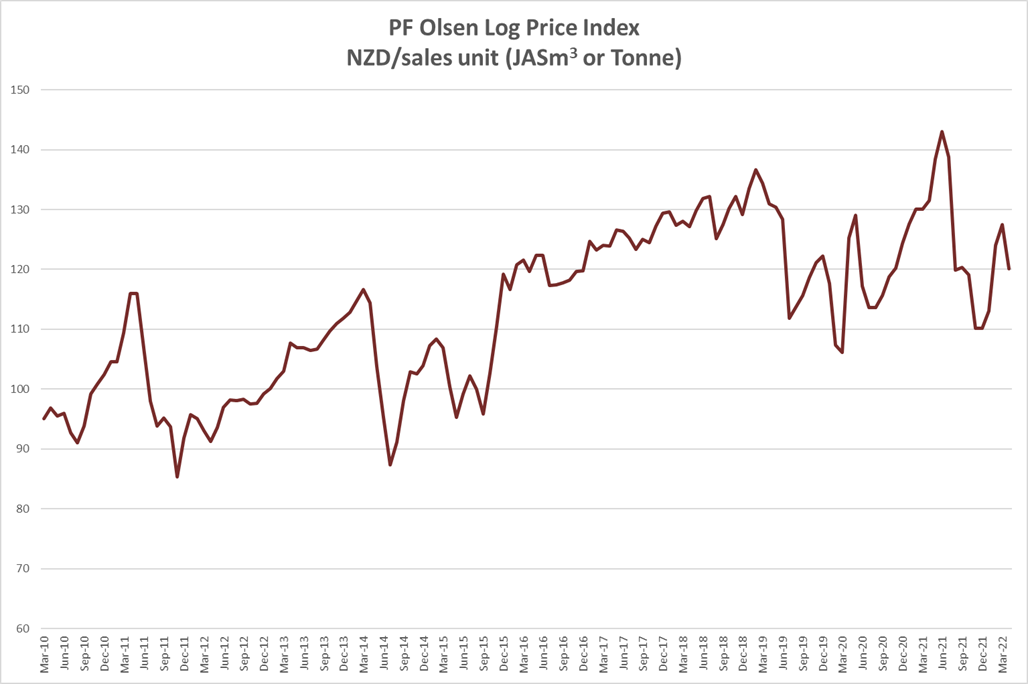

The PF Olsen Log Price Index dropped $8 to $120 which is $3 below the two-year average, $1 below the three year-average and $4 below the five-year average.

Domestic Log Market

Log Supply and Pricing

There has been virtually no change in price and supply volumes to domestic customers. There is not much domestic proessing capacity on the East Coast of the North Island where the storms have disrupted log supply.

Sawn Timber Markets

China

The total log demand in China has reduced since last year’s real estate and construction crisis in China due to Government crackdown on speculation and a tighter lending environment. Log supply has also reduced dramatically. Due to COVID-19 and Russia’s invasion of Ukraine significantly affecting the supply chain, we are yet to see where the balance between supply and demand truly sits.

China imports of softwood logs in the first Quarter of 2022 was 44% down on Quarter 1 2021. New Zealand’s log supply was 25% down. Log supply will remain constrained. New Zealand is entering its winter months, and price instability has not encouraged a significant increase in harvest levels. Supply from Europe and North America will also remain lower than last year.

Log vessels currently must wait an average of 10 days in Tauranga before berthing. Not because there are increased log volumes, but most log exporters from New Zealand did not sufficiently prepare for the change in fumigation rules. Many exporters are now queuing while they debark more logs.

Reductions in log volume to start Quarter 2 has also been caused by COVID-19 disruptions to staff levels in New Zealand and storms in the East Coast region of NZ.

India

Kandla port is forecast to be very busy with four log vessels arriving from Uruguay and Argentina as well as two from Australia at least one from USA arriving in May. There is however an expected three weeks berthing delay for these log vessels, due to priority berthing facility accorded to export wheat vessels. Wheat exports from India are increasing significantly due to the Russian invasion of Ukraine.

Because of ongoing container shortages for export of Indian products, demand for sawn timber as packing material is subdued. Gandhidham green pine sawn timber is INR 631 per CFT for Uruguay pine and INR 681 per CFT for sawntimber from Australian logs.

The Tuticorin green sawn timber price is stable at INR 750 levels, with some containers of pine logs arriving from South Africa.

The arrival of Australian and New Zealand logs and lumber in containers has totally stopped, due to the container freight increase to Indian ports.

On-arrival Methyl Bromide fumigation relaxation notification is overdue from March 31. This has resulted in cessation all pine, spruce, poplar, beech log imports from European countries. Meanwhile, Ethanedinitrile (EDN) has been approved by the New Zealand EPA to fumigate pine logs. The Indian Plant Quarantine authority might follow suit. If that happens, bulk log vessels from New Zealand may recommence.

Exchange rates

The NZD strengthened from 0.6693 at the end of February to 0.6974 at the end of March. The NZD has weakened against the USD during April which is good for May AWG prices.

NZD: USD

CNY: USD

Ocean Freight

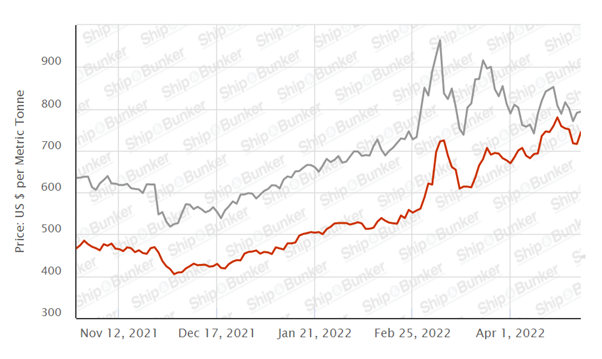

Shipping costs from New Zealand have been volatile over the last six weeks.

Source: TradingEconomics.com

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – April 2022

The index dropped $8 to $120 which is $3 below the two-year average, $1 below the three year-average and $4 below the five-year average.

Indicative Average Current Log Prices – April 2022

|

Log Grade |

$/tonne at mill |

$/JAS m3 at wharf |

|

Pruned (P40) |

180-200 |

160-180 |

|

Structural (S30) |

120-155 |

N/A |

|

Structural (S20) |

100-105 |

N/A |

|

Export A |

N/A |

129 |

|

Export K |

N/A |

121 |

|

Export KI |

N/A |

113 |

|

Export KIS |

N/A |

105 |

|

Pulp |

46 |

N/A |

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.