Log Market – February 2023

|

Scott Downs Director Sales & Marketing PF Olsen Limited |

Market Summary

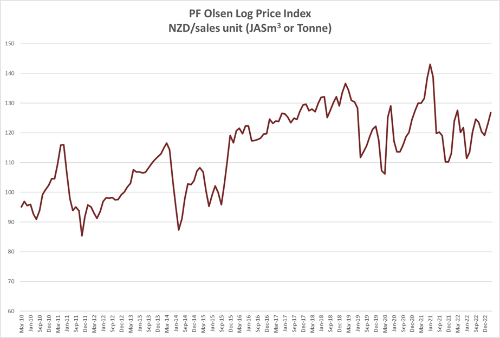

The PF Olsen Log Price Index increased $4 in both January and February to $127. The index is now $4 above the two-year and $3 above the five-year average.

Domestic Log Market

There was very little change in log prices around the country for Quarter 1. Pruned logs remained unchanged while in some regions structural logs reduced by about $1 per tonne.

While there have been plenty of building consents, these are not translating into projects starting. This is due to a combination of poor weather, high interest rates and business uncertainty.

There is an oversupply of structural sawn timber and many mills are actively reducing production. There is price pressure as sellers look to maintain or increase their market share.

Many sawmill managers say this is the worst decking season they can remember. Clearwood is used to manufacture premium decking. Exports prices for clear sawntimber into Europe specifically are still strong.

Sale prices for sawn timber into Asian countries continue to fall. Some grades have fallen as much as 40% over the last six months.

Export Log Market

China

India

Prices for green sawn timber in Gandhidham have risen by about 8% since the start of the year. South American green pine are 541 INR per CFT while Australian radiata green pine sells for 601 INR per CFT. The price for European kiln dried sawntimber has increased about 15-20% and is now 700-750 INR per CFT.

About seven or eight vessels are expected to arrive at Kandla from South America and Australia during March. Demand is not increasing despite weather turning warmer, as exports are slow and real estate markets are down.

Kandla customers also understand one unsold Handymax vessel enroute from South America was diverted to China. After seven months of oversupply, Kandla might see shortages in Quarter Two as China log buyers chase Uruguayan supply.

Tuticorin receives logs in containers from South Africa and the USA. The local green sawn timber price is 700 to 750 INR per CFT. The bulk vessel possibility from South America is still a mirage for Tuticorin buyers, who are unable to compete with Kandla. Gandhidham lumber is flooding traditional Tuticorin markets like Chennai, Bengaluru, Hyderabad, along with cheap European kiln dried lumber.

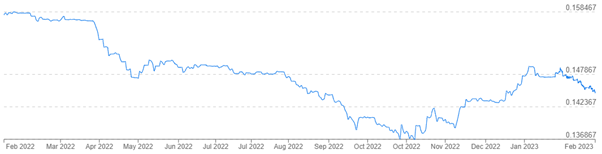

Exchange rates

The NZD strengthened one cent against the USD in January but has dropped two cents against the USD in February. The CNY has stabilised against the USD in the last couple of weeks. Conversely the CNY has weakened against the USD since the end of January.

NZD:USD

Ocean freight

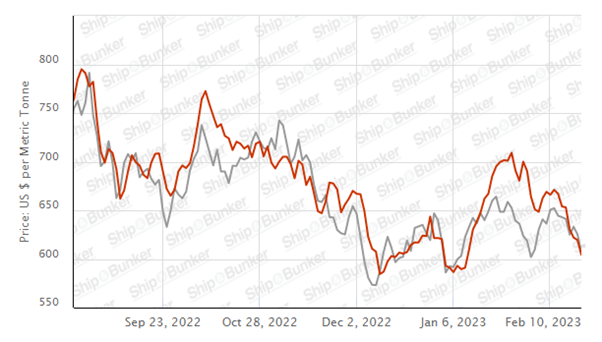

Shipping costs have stabilised with 30 USD per JASm3 the average shipping rate from the North Island of New Zealand to China. The Bulk Dry Index has dropped to its lowest point since the middle of 2020.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - February 2023

The PF Olsen Log Price Index increased $4 in both January and February to $127. The index is now $4 above the two-year and $3 above the five-year average.

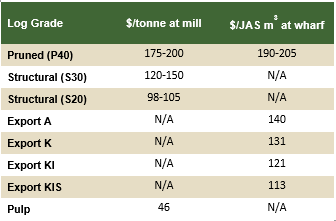

Indicative Average Current Log Prices - February 2023

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs.

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only and specific advice sought for individual forests.